D&D Wasn't "Under Monetized," but Belief that it was Probably Hurt the Brand

Alienating D&D fans might discourage them from buying "Lifestyle" items.

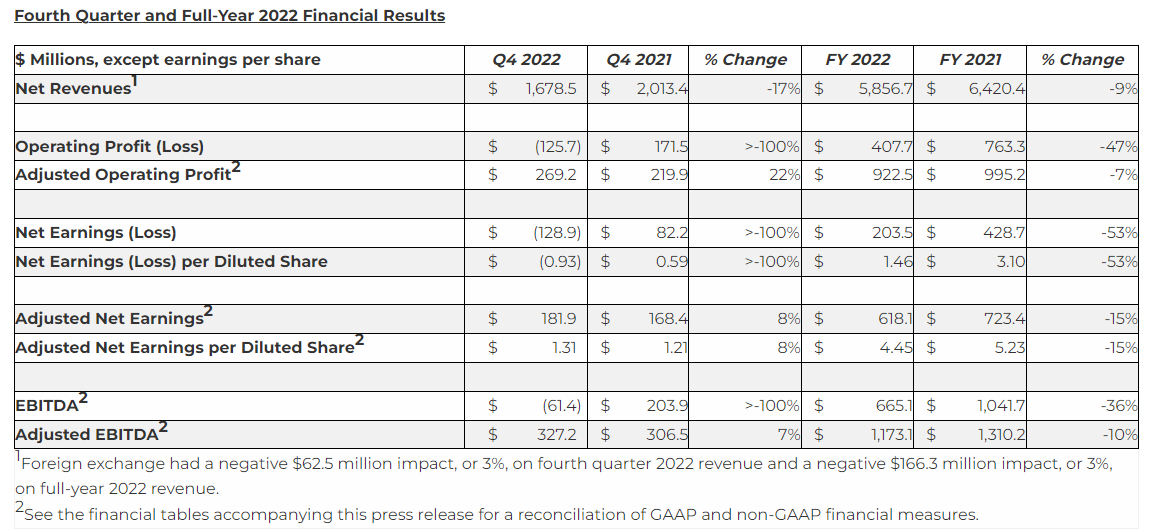

The Hollywood Reporter recently reported that Hasbro’s year-end financials presentation to shareholders showed that the company had posted a HUGE loss in the 4th Quarter of 2022. The loss was so bad that it represented not merely that the 4th Quarter of 2022 was less profitable than the same period the year before, but that net earnings had swung $200 million in the wrong direction resulting in a $129 million dollar loss for the quarter. As you can see by the financials, this terrible 4th Quarter was a part of a very bad year for Hasbro, a year where overall fiscal year profits dropped by 53%. That’s a bad year by any standard.

When you keep this information in your mind, it kind of helps to make sense that the company might report that they think the Dungeons & Dragons brand is “under monetized” when compared to video games. Dungeons & Dragons and Magic the Gathering have come to be among the most valuable brands that the company has and if you see a decline in revenue from most brands and a stagnation in revenue from your premier brands, it makes sense to think they may not be earning as much as they should. The Pareto Principle implies that 80% of the revenue tends to (some interpret this as should) come from the best performing 20% of your offerings. There are some benefits to this kind of structure. It allows companies to use the success of products in the 20% to pay for innovation and experimental products that might become the new 20% in the future. It can also lead management to make bad decisions if they assume that the same brands/products will be that 20% in the future. Steve Jackson Games is a company that manages to balance the changes in the market shifting which of their products are that 20% with innovation and growth, all without damaging their brand.

Hasbro, on the other hand seems to be in a position where the market is shifting in some ways and that their revenue rich Magic the Gathering may be less stable than many fans assume. Bank of America announced last year that it thinks that Hasbro has begun engaging in over saturating the market for Magic and that this is killing that brand. Recent sales figures suggest that this might not be the case. They also show that Magic makes up only 18% of Hasbro’s overall revenue, but it is a growing revenue stream as others are shrinking. D&D is too and it looks like Hasbro is looking to Magic and D&D to become an even larger part of their revenue production and this might have prompted comments about “under monetization.”

Talk of under monetization of the D&D brand actually make sense when you look at the game from a certain perspective. Setting aside commentary about microtransactions, subscriptions, or any other recurring revenue streams that come from the video game industry and focusing only on the basic foundational transaction in any game (video or tabletop).

What is the basic monetization of D&D? Who provides the foundational revenue stream from which all others are built? Is it players? No.

In Magic, every player has to buy their own cards. In the modern video game environment, if I want to play a game I have to have my own copy. Long gone is the old Atari/Sega assumption that game night meant local multiplayer experiences. Sure, every now and then you find a game that allows for local multiplayer, but far more typical today is the online multiplayer experience and LAN parties were there even in early PC gaming. The players are the foundation of card game and video game revenue. In D&D, the foundational revenue stream is the gaming group. I intentionally didn’t use Dungeon Master here because while it may often be the Dungeon Master footing the lion’s share of the expenses (80/20 D&D expenses?), many groups share those expenses.

What do I mean by this? After all, you might say “but every player has to buy the Player’s Handbook?” No they don’t. Only one player in a group, who is willing to share that book, NEEDS to buy it. Everyone who wants to play Total War: Warhammer III online needs a copy of the game. There’s no sharing, you either own the game or you don’t.

In D&D, there is the possibility, and the reality, of sharing. For the group that I run for my daughters and their friends, a group of about 8, I’m the “library.” The DM’s got the books. I’m the one who pays the premium on D&D Beyond so everyone can make characters. I don’t expect the teens to have the money, then again I never expected my players to have the money. Even when I was playing with a largely adult group, I was lending out books and paying for playmats and minis and virtual table tops and… Did I get reimbursed by the group? No, but many groups consider these shared resources and split the burden. That’s why I said that it was the DM.

So how can you increase the monetization of the brand? Well, you can go the video game microtransaction route, you can attempt to eliminate any competitors in the market via brute force tactics, or you can be a lifestyle brand. There are other ways to be sure, but these are the key strategies that Hasbro decided to focus on in the past year.

Along the lines of the first strategy, Hasbro has been working on creating their own virtual table top for the D&D game that will launch with their next update to the game. They want to build on D&D Beyond to make it more than a play facilitator and turn it into a play environment where everyone subscribes. This has pros and cons, but in and of itself it would be “fan alienation neutral.” Some fans would use it, others wouldn’t. When combined with the second strategy though, that creates a shitstorm.

Earlier this year, Hasbro attempted to revoke the Open Gaming License (OGL), a license that allowed other companies to create products compatible with the D&D game. Among these products were a host of independent role-playing games ranging from products designed to be used directly with the 5th Edition of Dungeons & Dragons to “Old School Renaissance/Revival/Revolution/Rebirth” (okay, just OSR) games that captured the play and feel of older versions of the game. Also included in these compatible products were a host of excellent virtual table top environments like Roll20 (who based on my most recent PayPal transaction may have purchased DriveThruRPG) and Fantasy Grounds to name only two.

There has been a lot of conversation about how controversial third party game designers like Justin LaNasa influenced Hasbro to push to eliminate the OGL, and I can’t dismiss that Trademark and IP fights have any influence, but I think those conversations miss the mark. When Hasbro has spent close to $150 million dollars to purchase D&D Beyond from a licensee and Roll20 has 10 million users, I think that matters a lot more than an IP fight that is going to cost a couple of million dollars. The decision was about pushing out competitors and not about a small company. The question is, how do you get Roll20 users to shift over to D&D Beyond (though many use both)? One way is to make a better product. The other is to kill the competition by any means necessary. I think that’s why they made that move.

That had consequences though. In their push to kill the OGL, the company infuriated their fanbase. So much so that Bank of America again downgraded their stock. That’s a lot of good will lost and it’s good will that fuels the third revenue stream, becoming a lifestyle brand. Just as D&D related products were really building in these lines, they alienated their fans and that was plain stupid.

In what ways were they building the brand? Well, they have a new movie coming out.

More than that, they had a host of excellent and nostalgic products coming down the pipeline. Products that I pre-ordered, but that others might have had to wait to see.

These include:

Really Cool Lookin D&D Action Figures Based on the Old Cartoon

And so much more. Those are just a couple of the things I purchased, or received as a gift, in the past couple of months. They were on a roll, a roll that could have really launched the D&D Beyond service into the stratosphere. The mere purchase of that platform gave them a revenue stream. Making it better would have added revenue. Licensing products to Roll20 and Fantasy Grounds would have ensured that you were even making revenue off of competitors. They had a host of options and they chose the worst one, attack the fans and the market. In other words, they attacked those who are the lifestyle that they are trying to transform to brand.

I stopped buying the lifestyle brand stuff, until Hasbro reversed course, and I was too embarrassed by their attack on the fanbase to show off the cool stuff that was arriving from my pre-orders. That’s the opposite of brand building, that’s brand killing. I was ashamed to be associated with the brand.

Now, I’m the forgiving sort. Hasbro has apologized and reversed course by putting the rules into the Creative Commons and that’s enough for me. It’s not enough for others and I can’t, and won’t, ask them to change their minds. That’s up to those individuals. The thing is, Hasbro had a way to monetize those fans and instead it chose to alienate them. Now they have to win them back, and that won’t be easy. I hope they’ll keep releasing cool stuff though.

Thanks for sharing. Here’s the announcement about Roll20 and OneBookshelf “uniting the party” in July: https://blog.roll20.net/posts/roll20-onebookshelf-are-uniting-the-party/

Great read. I think another factor though less quantifiable is the change in culture at Hasbro slowly over time that has led us to this moment. The want for a quick influx of revenue is short sighted when they have a great product with a history that few products have achieved in the geek zeitgeist, yet they seem to be squandering that potential. It'll be interesting to see what the future holds for D&D and Hasbro.